DCA vs. Lump Sum Investing: Finding Your Strategy During a Bull Run

DCA vs. Lump Sum Investing: Finding Your Strategy During a Bull Run

With the bull run charging ahead, everyone’s buzzing about how to maximise gains without betting the farm in crypto. At Bamboo, we believe in investing on your own terms—because it needs to be sustainable. Two popular strategies to think about are Dollar-Cost Averaging (DCA) and Lump Sum Investing. Let’s break these down—and see which one might be calling your name.

What’s Dollar-Cost Averaging (DCA)?

DCA is like ordering pizza🍕by the slice rather than the whole pie—you’re investing in smaller, regular amounts instead of going all-in. This approach is popular with anyone wanting to grow their portfolio steadily while sidestepping those nerve-wracking market swings (and unnecessary calories 😆)

But here’s a hypothetical: if you could time travel, would you dump your life savings into Bitcoin ten years ago, or stick with that steady monthly drip? For those of us without an AI-powered crystal ball, DCA offers a way to invest without FOMO and sleepless nights.

Why DCA Works in Bull Markets

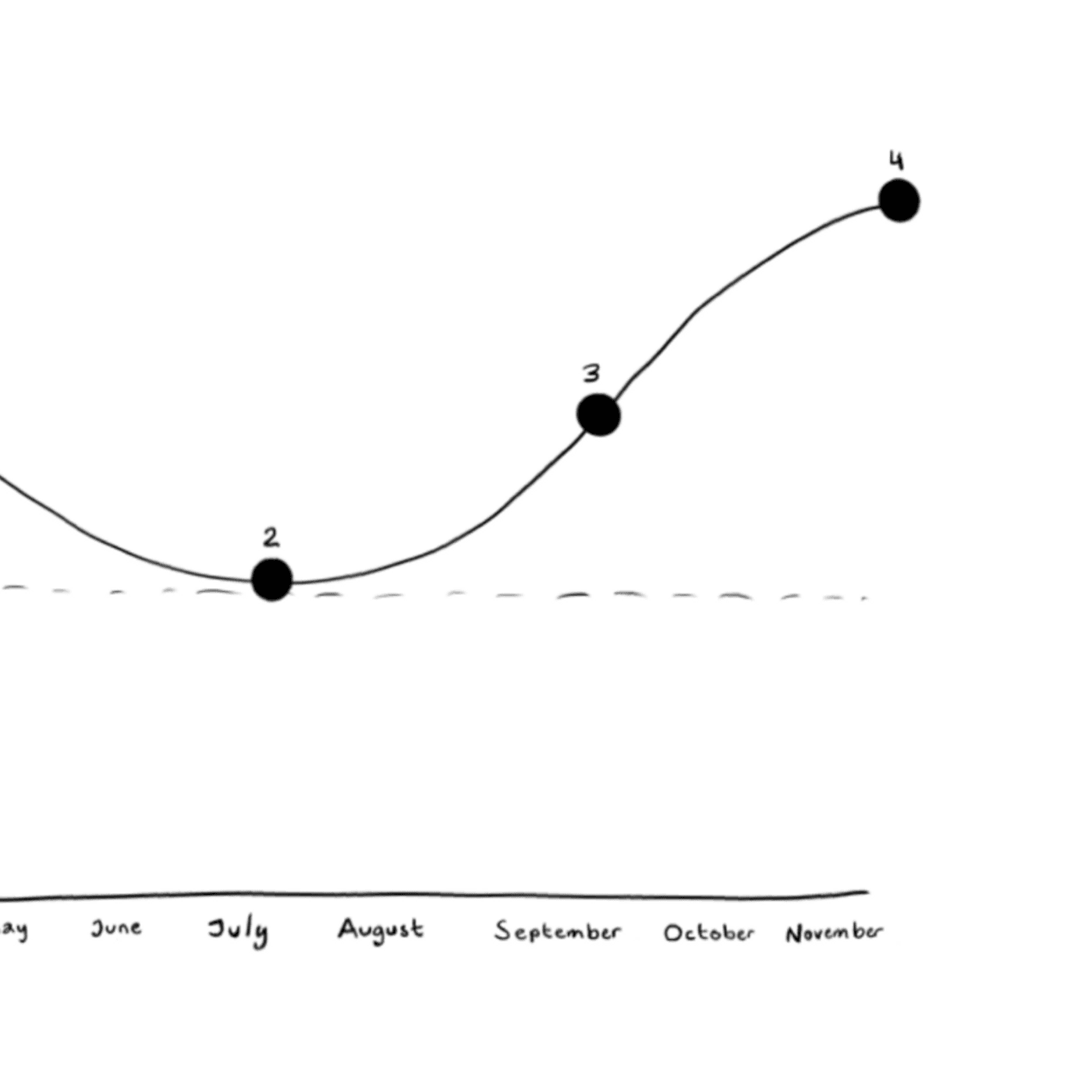

In a bull run, DCA can help you dodge the stress of watching prices bounce up and down. By investing gradually, you snag more when prices dip and avoid buying too high when they spike. Sure, you might not catch every high, but you’ll avoid going “all-in” at the peak.

Bamboo’s** Recurring Top-Up** feature is perfect for setting up a DCA approach that practically runs itself—just pick an amount, set the frequency, and let it do the heavy lifting.

The Case for Lump Sum Investing

With Lump Sum Investing, it’s all about putting your chips on the table right now. You’re throwing down a larger amount at once, banking on the bull run to do its thing. This approach is popular with those with a higher risk tolerance (or a solid stash of coffee for those sleepless nights).

Put it this way - if you found $10,000 in your old jeans, would you dive head-first into the market today or spread it out slowly? Have a little think about that (then go shout yourself some new jeans!!).

Why Lump Sum Makes Sense in a Bull Market

In a bull market, it’s tempting to jump in and let your investment enjoy every rise. Lump sum lets you lock in today’s prices taking advantage of immediate market gains.

With Bamboo’s Instant Investment feature, you’re ready to seize the moment. See an opportunity? Grab it with a quick top-up, boosting your portfolio when the market looks promising 🙏🏼

Which Strategy is Right for You?

Both methods have their perks, so choosing between DCA and Lump Sum is a matter of knowing what works for you:

Risk Tolerance: Lump sum can be a bit of a thrill ride, especially with crypto’s ups and downs. DCA is more like wading in slowly, getting a feel for the waves.

Market Conditions: Bull runs favor lump sum strategies, but DCA remains a consistent choice if you prefer something lower-stress.

Personal Style: Love simplicity? DCA might be your match. Ready to make a move? Lump sum lets you dive right in.

Why Choose Bamboo? 🌱

Whether you’re a DCA fan, lump sum loyalist, or a mix of both, Bamboo has you covered. With automated Recurring Top-Ups and Instant Investments, building your crypto portfolio is as easy as choosing a strategy and letting the market do its thing.

Bull runs bring opportunities, and whether you’re here for steady gains or a big bet, there’s no better time to start. Ready to find your strategy? Dive into Bamboo today.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter